In our current world, where everything is digitalized, technology is the root of almost everything. Fintech in Personal Finance has significantly impacted how we manage our money, often without us even realizing it.

It can be as simple as buying yourself something to how you budget and invest for your future. For example, people no longer have to queue in banks or keep financial documents for future use. Managing our personal finances or rather money has now become easier and faster, thanks to Fintech. Let’s see how we use Fintech in our Personal Finances and its impacts.

Fintech and Your Daily Transactions

Quick question, how do you pay for things occasionally these days? Do you use cash or contactless payments and mobile apps like Apple Pay, PayPal, and M-PESA? These are examples of actively using fintech in your personal finances.

Earlier on, you’d probably need to carry a wallet full of cash or all your cards, now you can just take care of all your transactions just by a simple tap on your phone. It’s convenient since today we are always with our smartphones making everyday purchases smoother than ever.

Mobile apps have also made it possible to track your finances from anywhere and anytime. It could be as simple as checking the balance of your finances, sending money to someone or even receiving money yourself. We no longer have to go to a physical location like banks for our finances. With fintech, banking fits into your schedule, not the other way around.

Personal Finance Management With Fintech

Most of the time when someone talks about managing finances or we are asked so, we find it cumbersome or difficult.

However, fintech has made the management of personal finance easier. Apps like Mint which is ideal for those who want a full suite of tools to manage their finances, Kiihela which is a Kenyan budgeting app that helps you track your expenses, and YNAB (You Need A Budget) designed to help users give every dollar (or shilling) a job. These apps give you clear insights into your financial habits.

The best thing about fintech tools is that you don’t have to be a financial expert to use them because they are user-friendly. They are designed to help you understand your money better and make informed decisions. You can set budgets, see your spending trends, and even get notifications if you’re about to go over your limit. It’s just like having a personal finance advisor who you can access anytime and anywhere helping you build your wealth.

The Security and Convenience of Fintech

People often worry about security especially today with technology that is easily accessible. Well, you don’t have to worry about that with fintech apps. Many fintech apps use advanced encryption and two-factor authentication to protect your personal and financial information. This means that your data is safe, even when you’re managing your money online.

Fintech isn’t about just making things secure but also convenient. Take peer-to-peer payment apps like Venmo and PesaPal or even M-Pesa, for example. If you need to make payments or receive payments like sending money to friends and family, paying for dinner, pay a friend back for event tickets, it’s as easy as a few taps on your phone. Fintech has simplified even the smallest personal finance tasks.

Fintech for Business

Besides being great for individuals, fintech is also transforming how businesses operate. Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) benefit from fintech services like digital invoicing, payment processing, and crowdfunding. Fintech tools like Square and Stripe allow businesses to accept payments from customers anywhere in the world, making it easier to grow and thrive in today’s digital economy.

Fintech is also helping businesses manage their finances better by providing insights into cash flow, expenses, and profits. Cloud-based accounting services like QuickBooks and Xero streamline bookkeeping allowing business owners to focus more on running their business and less on crunching numbers. This has been life-changing for businesses.

Fintech’s Impact on Credit Management

Fintech has revolutionized almost every aspect of finance including credit management. Earlier, managing credit meant dealing with a bunch of paperwork, miscalculating the interest rates, unsure of the exact amount of credit given, and a lot of uncertainty. Thanks to fintech, the way we understand, manage, and access credit has transformed, making the process smoother and more transparent for everyone.

How Accessing Credit Has Become Easier

Before, applying for a loan or a credit card was like climbing a mountain with obstacles. The application which included paperwork, waiting for approval, and going back and forth for credibility was tiring. Today, with fintech applying for credit can be done with your phone. Companies like SoFi, Ngao Credit, and C24 Capital have created platforms that allow you to apply for loans or credit cards entirely online with convenience and fast approval. You can even compare different offers side-by-side, ensuring that you get the best deal.

Fintech companies often use advanced algorithms to assess your creditworthiness. This means they can look beyond your credit score and consider other factors, like your income or spending habits, making it easier for more people to qualify for credit. Whether you need a personal loan or a buy-now-pay-later option, FinTech has made the process more accessible and less intimidating.

Fintech credit management has also been personalized. You get loans structured according to your needs. These platforms use technology to analyze your spending habits, existing debt, and even your goals to suggest the best loans for you. This level of personalization ensures that you’re not just getting any credit, but the right credit that works for your financial situation. You are no longer left wondering if you made the right choice because fintech helps you make informed decisions in your personal finances from the start.

Instant Credit Monitoring

Another way fintech has made managing credit easier is through real-time credit monitoring. You don’t have to wait for a credit report to access your credit information.

Access and monitor your loans through mobile apps. It has also made it easier to get the information you need about your credit instantly since credit apps monitor your credit scores and provide updates whenever there’s a change in your credit score.

This real-time access to credit information empowers you to stay on top of your credit information. If there’s a dip in your score or an error on your report, you can easily and quickly address it. You’ll also get personalized tips on how to improve your score, whether it’s by paying down debt, reducing credit card usage, or setting up payment reminders. With fintech’s help, credit management becomes proactive rather than reactive.

Reducing Credit Risk

Fintech has also been a game-changer for lenders. Using AI and machine learning, fintech companies can more accurately assess credit risk. Instead of relying solely on traditional credit scores, fintech lenders look at other data points, such as spending patterns, employment history, and even social media activity. This helps them better evaluate borrowers’ ability to repay, leading to more fair lending decisions and reduced risk.

This means you’re more likely to receive an offer that reflects your financial situation. It also makes credit more accessible to people who traditional banks may have denied due to low credit scores or lack of credit history. Fintech lenders can approve loans for a wider range of customers, offering competitive rates without taking on unnecessary risk.

Managing debt can feel overwhelming, but fintech tools make it easier to stay on track. Debt repayment apps help you create a plan to pay off your debt efficiently. Whether you’re juggling multiple credit cards or dealing with a large loan, these platforms offer personalized strategies to help you pay off your debt faster and with less stress. As much as fintech gives you easy access to credit and impacts credit management positively, always understand what is needed and how a fintech credit app operates before taking loans.

Financial Planning With Fintech To Improve Personal Finances

Financial planning is not for specific people, it’s for you, me, and everybody else who wants a bright financial future. Whether you are saving for future emergencies, for a small or big purchase, or want to start investing, financial planning is a step towards achieving all of it. Paying off all your debts could also begin with planning your finances. Managing your money can be a challenge today with almost everything being pricy or expensive, but with the right plan and financial guidance, you can take control of your finances and achieve your goals.

Start with budgeting

A budget is a plan on how you will spend your money for a certain duration, a month, or more. This allows you to keep track of the money you are getting and the money you are spending. I know this might seem complicated but it’s simply breaking down your expenses starting with the most important things. First, identify what you need to spend every month like your bills. Second, track your expenses for approximately one to three months to allocate where your money goes. Finally, you can now set financial goals and it’s okay to start small within your means. Consider budgeting apps like GoodBudget and Centonomy Spending Tracker

Prioritize Saving

This is setting money aside for future use. Build an emergency fund which will be your financial safety net. Identify where you could build your emergency fund while still getting financial advantages like gaining interest. For example, you could use a Money Market Fund where your money is compounded yearly and there are limits to accessing your finances. Fintech has also made it easy to access Money Market Funds and track your finances from your phone. Incorporate a saving culture into your life, start now, and build your savings with time.

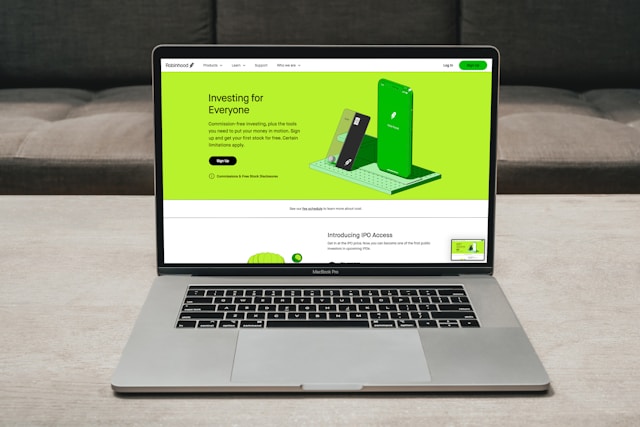

Invest for the Future

You don’t have to be a financial wizard to start investing for your future. Investing might sound complicated but you can use fintech apps that guide you on investing, hence elevate your personal finances. Whether through stocks, bonds, or mutual funds, the key is to invest regularly and think long-term. Thanks to compound interest, your money can grow significantly over time. If you’re unsure where to start, consider using apps that make investing easy for beginners.

Plan for Retirement

Retirement might seem far away, especially if you’re early in your career, but the sooner you start planning for it, the better. The power of compound interest also plays a major role here, so the earlier you start saving, the more your money will work for you. Even small contributions make a big difference in the long run.

Review and Adjust

A financial plan is a continuous thing. Once you start, you have to keep at it. Set a time of the year to review your financial goals with the help of the budgeting apps that track your finances.

Fintech in Personal Finance: A Boost for Mental Health

Managing personal finances can be a major source of stress for many, but fintech in personal finance is changing the game.With the rise of apps and platforms that simplify budgeting, saving, and investing, individuals now have the tools to take control of their financial well-being. These tools not only make managing money easier but also significantly reduce anxiety around financial uncertainty.

Fintech is empowering users to make smarter financial decisions, and in turn, reducing financial stress. For example, when you’ve budgeted your finances and built a savings plan you have a financial cushion when there are emergencies hence protecting your mental health financially during that time

On the flip side, financial instability can take a toll on your mental health, and this is where fintech plays a crucial role in prevention. By offering easy-to-use tools for financial literacy, debt management, and future planning, fintech solutions help people build confidence in their financial future.

This confidence translates to reduced stress, as individuals are better equipped to handle financial challenges. The combination of user-friendly platforms and greater financial control means that fintech isn’t just changing how we manage money but also helping us maintain our mental well-being.

In conclusion, fintech has transformed personal finance by making money management more accessible and efficient. With tools like budgeting apps, digital banking, and investment platforms, individuals can easily control their finances. As fintech evolves, it will continue to empower financial independence and stability in a digital world.